Gold has served as a symbol of wealth and a store of value for millennia. Today, it continues to play a crucial role in the global financial landscape. Gold shines as a unique investment choice, offering special benefits and characteristics that set it apart from other assets.

Gold's value stems from its scarcity, durability, and universal appeal. Throughout history, civilizations have prized gold for its beauty and intrinsic worth. In our modern world, gold remains incredibly important, playing a vital part in everything from state-of-the-art electronics to groundbreaking medical procedures, solidifying its place as an indispensable resource.

Investors often turn to gold as a hedge against economic uncertainty and inflation. Gold prices typically fluctuate due to a range of factors, such as international political events, changes in currency exchange rates, and overall market sentiment. Grasping these market forces is crucial for smart investing choices.

One of the primary advantages of gold investment is portfolio diversification. Adding gold to a diverse portfolio of stocks, bonds, and other assets can help investors reduce their overall risk and potentially protect their long-term financial plans. Gold often moves independently of other financial instruments, providing a counterbalance during market turbulence.

Several sovereign mints around the world produce highly regarded gold coins and bars. These government-backed institutions are known for their quality and authenticity.

The United States Mint stands out as a pillar of American numismatics. With a rich history dating back to 1792, the US Mint produces iconic gold coins such as the American Gold Eagle and American Gold Buffalo.

The Royal Canadian Mint stands out as another significant player known for pushing the boundaries with creative designs while maintaining a steadfast dedication to purity. The Canadian Gold Maple Leaf coin exemplifies their dedication to excellence in gold production.

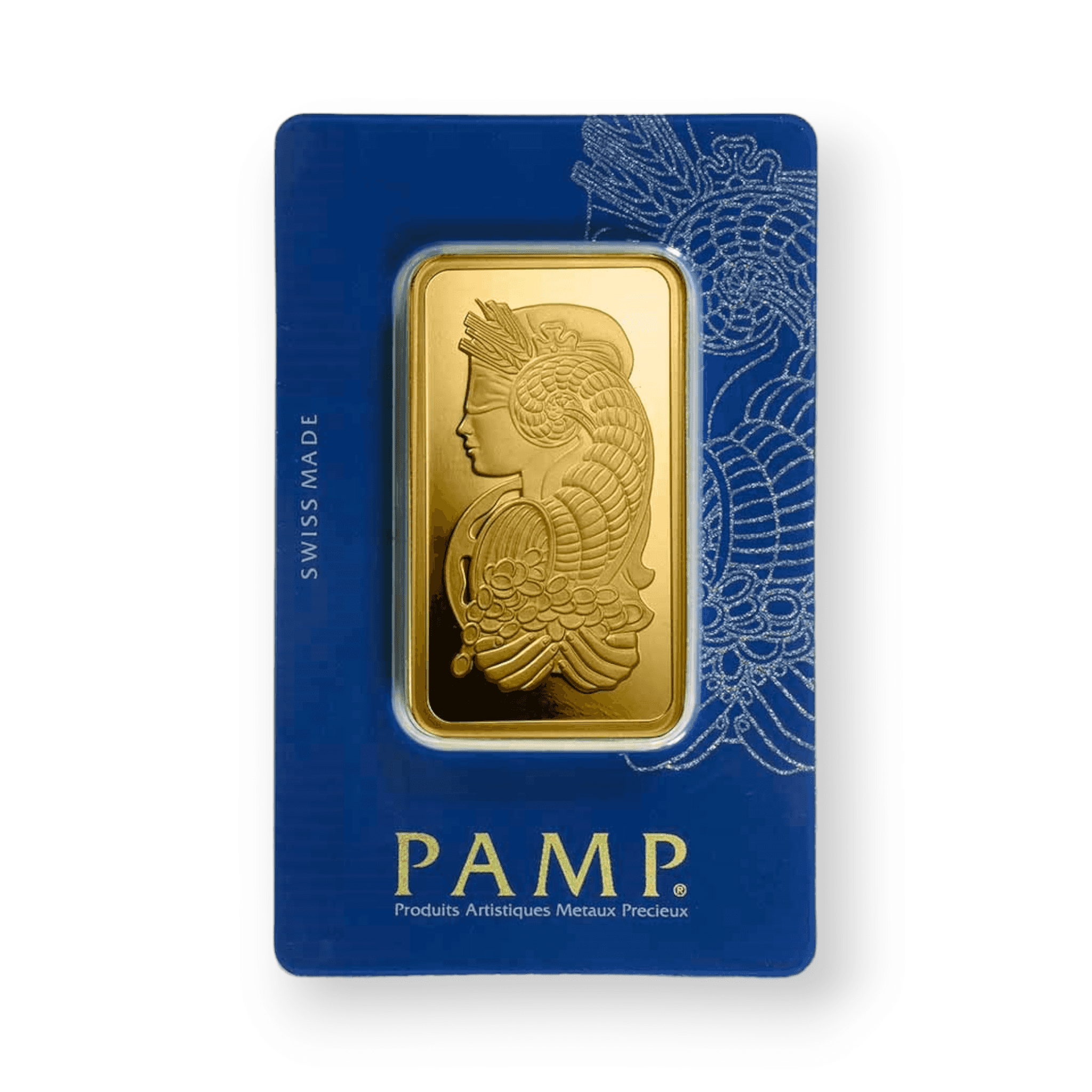

In addition to sovereign mints, private refineries play a significant role in the gold market. These entities specialize in producing gold bars of various sizes and purities.

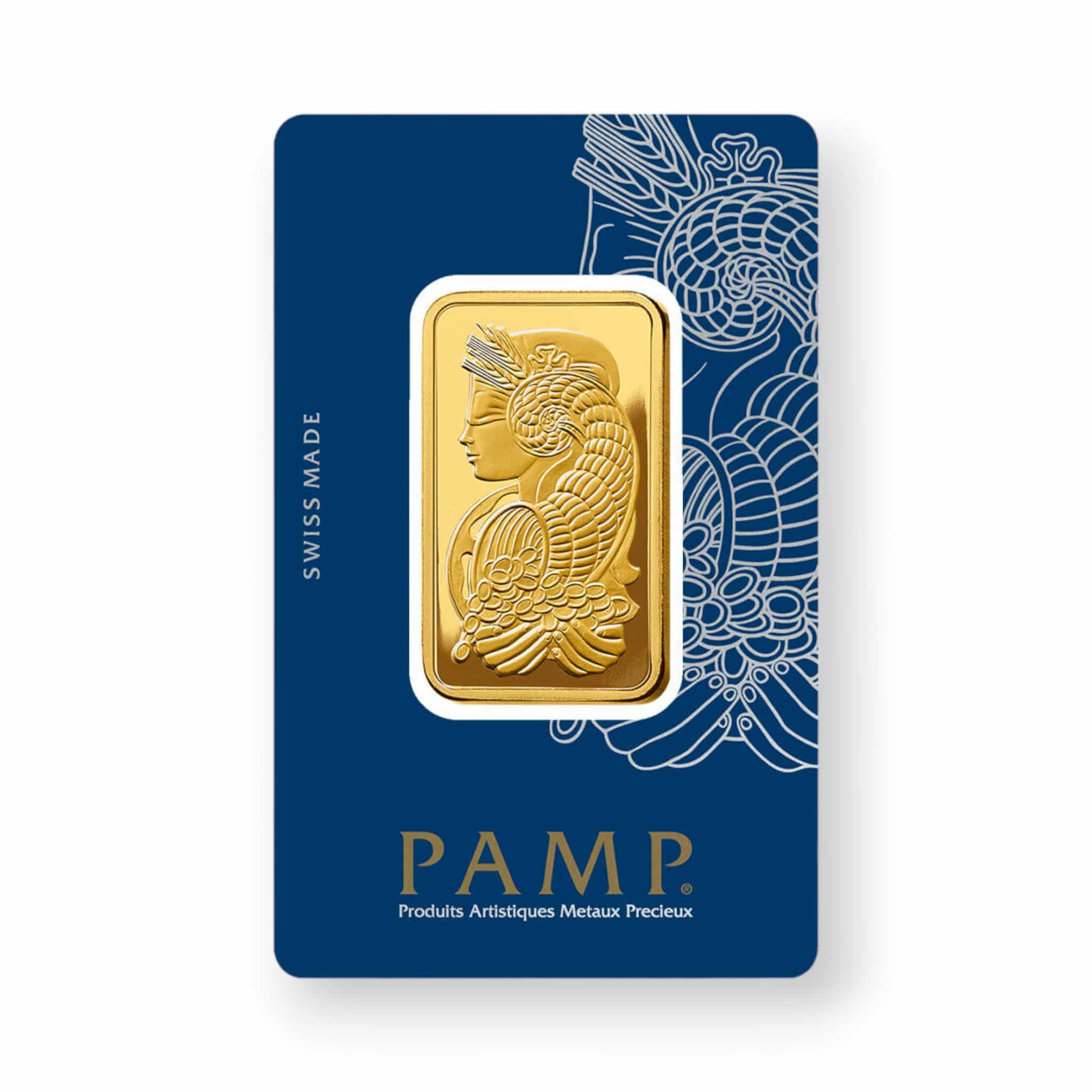

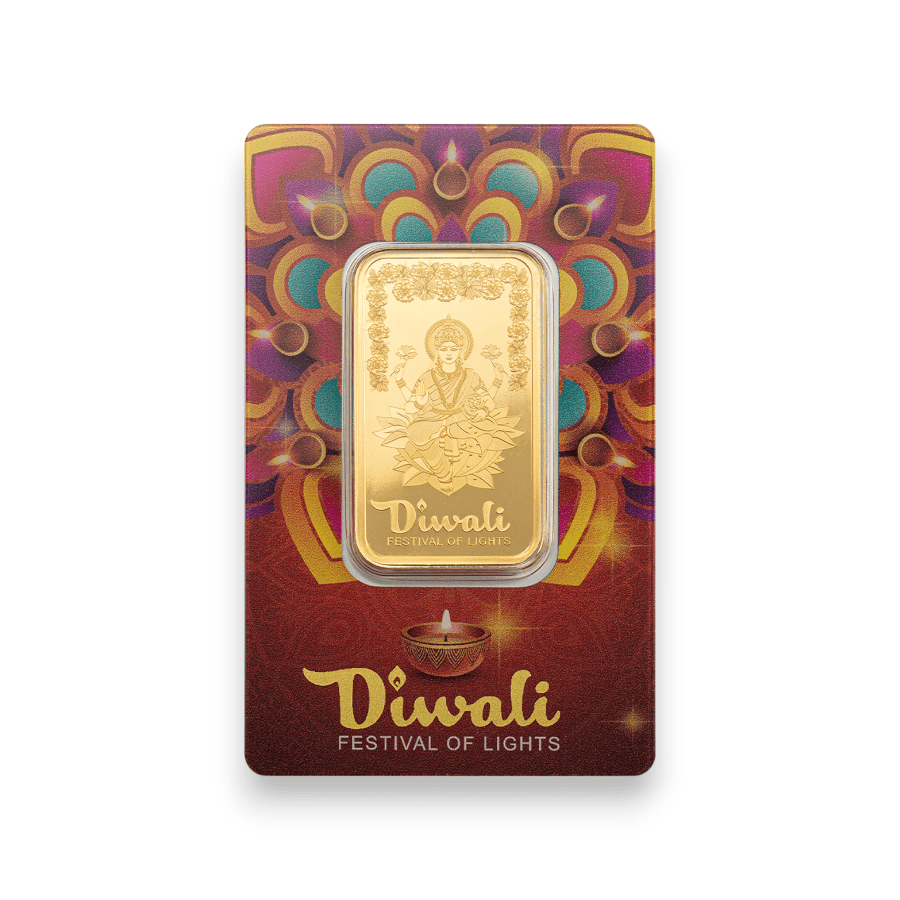

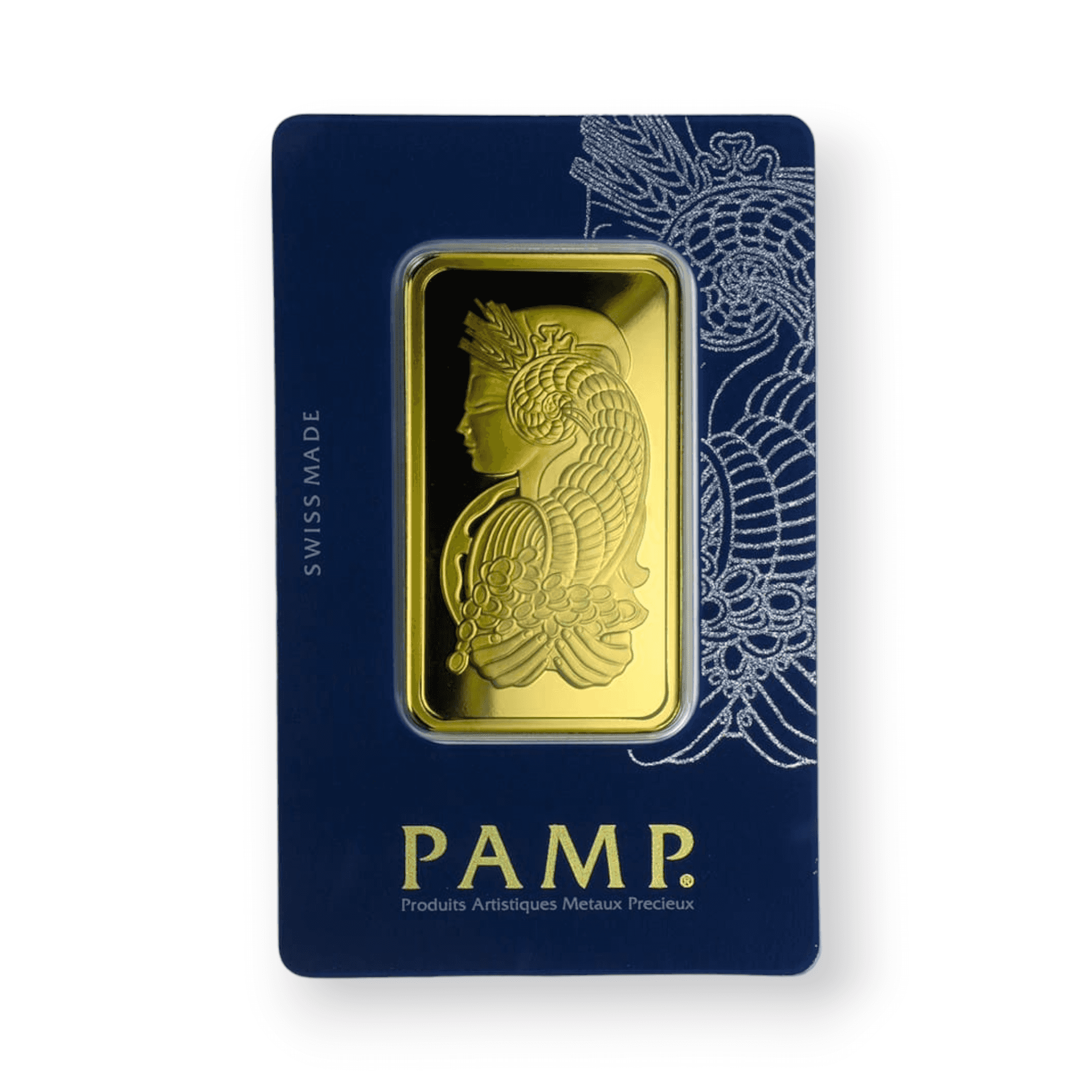

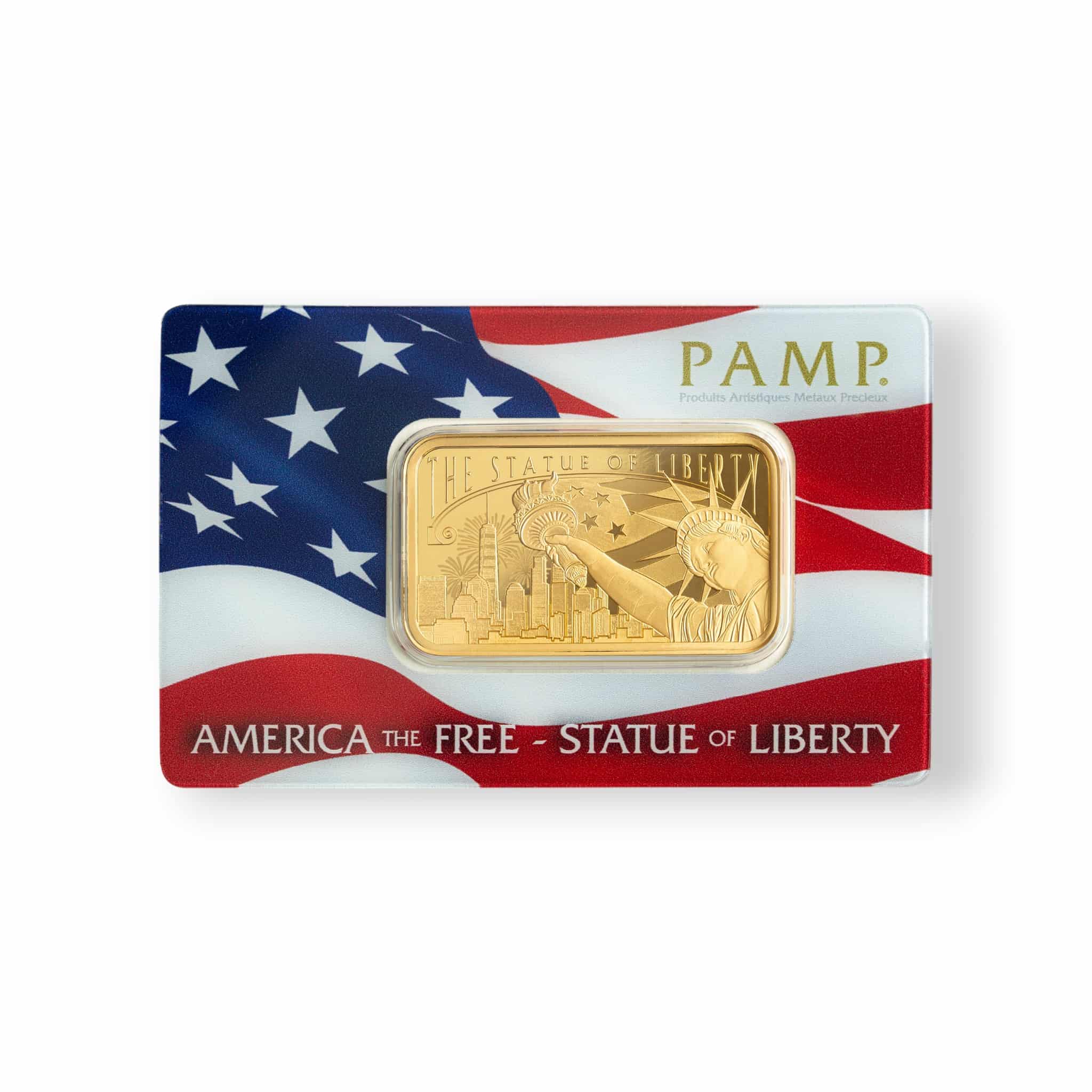

PAMP Suisse, a Swiss refinery, has earned a reputation for its artistically designed gold bars and advanced security features. Their products often appeal to both investors and collectors.

American Gold Eagle: This 1 oz coin features Lady Liberty on the obverse and an eagle family on the reverse. It contains 91.67% pure gold and is widely recognized in the investment community.

Canadian Gold Maple Leaf: Boasting a remarkable 99.99% purity, this coin features the beloved maple leaf design and comes in multiple size options.

American Gold Buffalo: This pure gold coin showcases a striking Native American design on the front and a majestic American bison on the back.

$20 Saint-Gaudens Double Eagle: A historic pre-1933 gold coin prized by collectors and investors alike.

The American Gold Eagle 1/10 oz offers a smaller take on the classic American Gold Eagle design, making it a great starting point for newcomers to gold investing or those on a tighter budget.

These products represent just a small selection of the diverse gold offerings available to investors and collectors. Every coin or bar has its own distinct features, backstory, and charm, appealing to different tastes and investment approaches in the precious metals market.