Ways to sell on the Orderbook-Style Marketplace

The pure marketplace is the first order book-style marketplace for the rare coins and precious metals community. It is meant for Dealers, Collectors, Wholesalers, and all of the above users to use it to buy and sell their items. The marketplace works exactly like the stock market, with bids and asks being broadcast throughout the entire day across a large range of generic products, which we like to call "tickers". These tickers are in turn traded regularly, where physical metals are moved to fulfill the orders.

Premium-Based Market

Each ticker can have its competitive market for which outside forces can impact the fluctuation of the underlying spot price, or price of commodities gold on the COMEX exchange. This is why Pure functions as a premium-based marketplace, where bids and asks are denoted by percentages over spot, dollars per ounce over spot, or just fixed prices. Premiums allow for hedging of the underlying metal and give our users a more transparent way to understand how much metal content is being owned for the price they are paying.

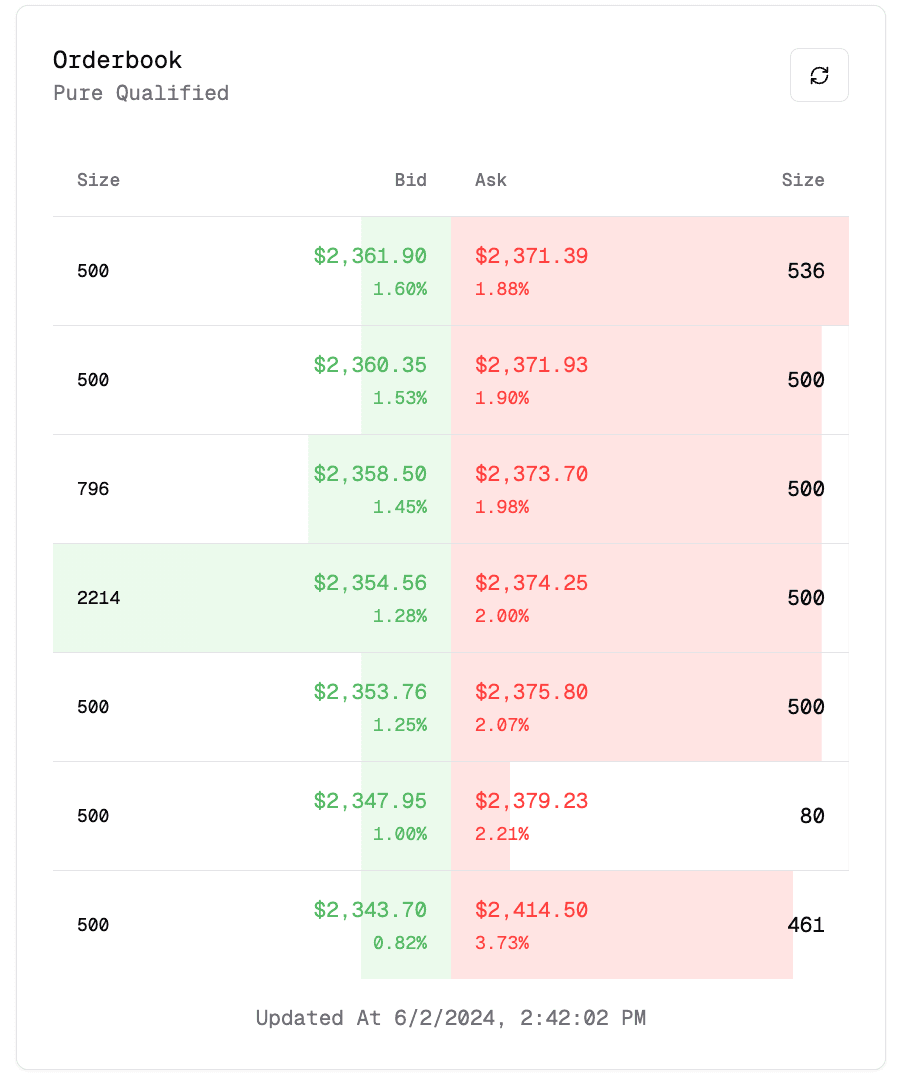

Take the 1 oz American Gold Eagle, for example, the most commonly traded coin in the United States and arguably in the world. As seen above, many different people would like to buy and sell this ticker. Bids are denoted as the green numbers, on the left side of the order book, this is how much you could sell one unit for (pre-fees). Vise-versa, on the right side, is the ask, which is how much you could buy one unit for (pre-fees). Size is the amount of quantity that the active bid or ask is making available at that specific price. Under each value of the bid or ask we place the corresponding premium to make sure each entry is transparent in price, note they are also ordered by ranking their value.

Selling a "Overfilled" Quantity

Now that we understand how the order book style marketplace works, we can dive deeper into the cool features the order book allows for in terms of selling.

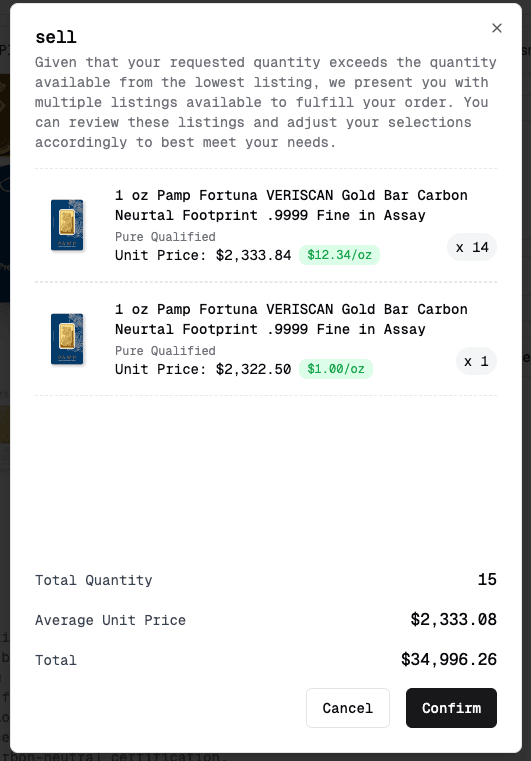

Say you have 15 Pamp Fortuna 1 oz Gold Bars, and the top bid in the order book shows only 14 available bids, the system automatically pulls the next available bid to complete the order. This allows for larger orders to be placed and filled depending on how many bids are available in the market.

Placing an Ask

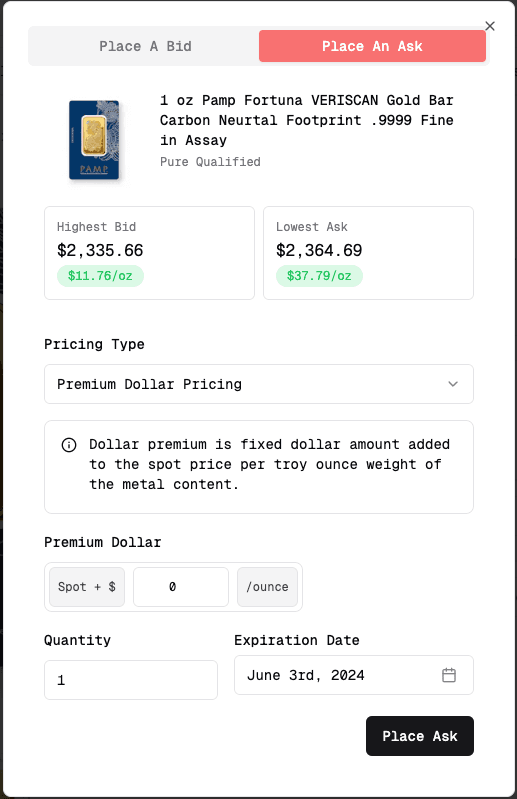

Say you've looked over the order book and the current bid is not high enough for your liking, you may also place an ask, which will then appear as the lowest ask if the price is competitive.

On each product page, below the product's pricing is a feature to be able to place an ask. Once signed in and clicking this box, you can then enter the market for your item using three different types of pricing.

Premium Dollar Pricing: Dollar premium is a fixed dollar amount added to the spot price per troy ounce weight of the metal content.

Premium Percent Pricing: Premium percent pricing is the positive markup added to the market spot price of the metal content.

Fixed Pricing: Fixed Pricing is the out-the-door price that does not account for the market spot price of the metal content.

Using these types of pricing, you can hedge the spot price of your metal to ensure you get the premium value that you would like to set. Note that fixed pricing is the out-the-door price that is set, and does not have any hedge associated with it.

Deactivating Listings

If you have a listing that you would no longer like to have active, you must navigate to the dashboard to be able to cancel this. Under the "listings" tab, each item has a deactivate button that will allow the listing to be canceled.

Support for Selling

As always, please feel free to reach out to support if you have a problem with selling items on Pure. We are happy to help faciliate the transactions and assist with your order at any time. Please do note that market loss is applicable if items are not fulfilled in the time outlined in the shipping terms & conditions.